|

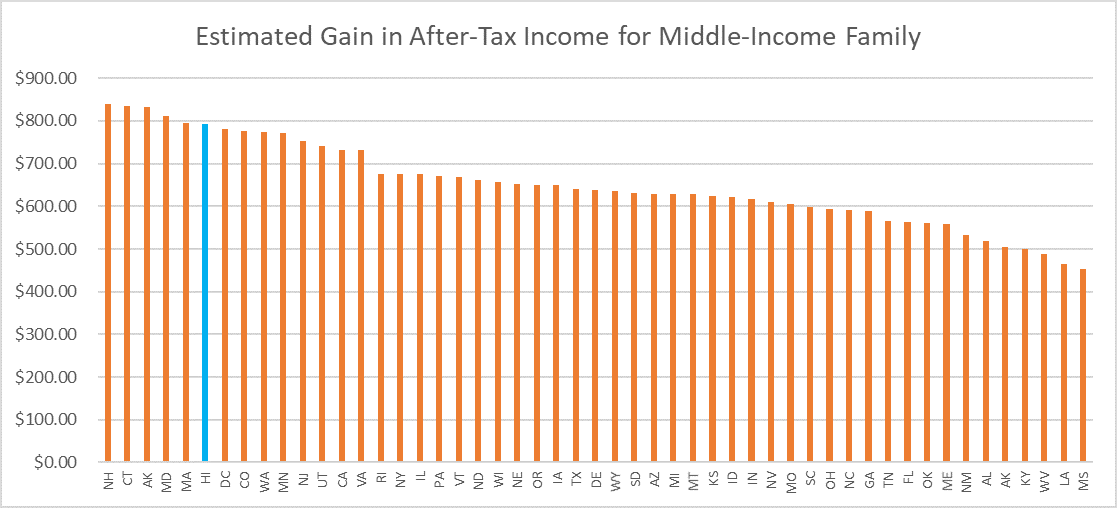

MTA Shares these commentaries, without taking a position unless otherwise noted, to bring information to our readers To view the archives of the Tax Foundation of Hawaii's commentary click here. Weekly Commentary For the Week of January 15, 2018 TrumpTax, Part I By Tom Yamachika, President As we nervously await the opening of the 2018 Legislature, we wonder how our state will approach tax conformity now that the Tax Cuts and Jobs Act, or “Trump Tax,” is now law. Most states, including ours, conform to federal tax law. That means we generally adopt the federal law provisions that tell us what is income and what we can deduct, so that most of us don’t have to figure out our taxable income many different ways. In fact, our most frequently filed income tax form, the Hawaii N-11, starts off with amounts reported on the federal return, and then adds and subtracts a few things to get Hawaii taxable income. Every year, our legislature is required to consider a bill to make our state income tax law conform to the federal changes made in the previous year. The legislature will have its work cut out for it this year, because Trump Tax made sweeping changes to the federal law. In a nutshell, Trump Tax did two major things regarding taxation of individuals: it dropped the tax rate for most people, but it limited or wiped out many deductions, making the tax base higher. The tax you need to pay to the federal government is figured by multiplying the two, and the net effect is what you see here, according to data put out by the national Tax Foundation: On this chart, Hawaii middle-income families take home more money on average. Hawaii families also appear to be doing well against their counterparts in other states.

When our state legislature conforms to federal tax changes, we typically adopt the federal provisions regarding what’s taxed and what’s deductible, but typically do not change the tax rates. If our lawmakers stick to that script this year, they will be hurting taxpayers, who will pay tax on a larger tax base but with the same rate as before. You might remember that the Tax Reform Act of 1986 also dropped rates and broadened the tax base to accomplish tax reform. Our legislators reacted by enacting Act 239 of 1987, which dropped our tax rates to offer relief from the base broadening. This time, our legislature should consider doing something similar. If they don’t, it will be functionally the same as raising taxes. If you don’t want this to happen to you, please let your legislators know that you won’t be fooled if they simply pick up the federal base broadening without doing anything to the state tax rate. It’s an election year, after all, and legislators need to know that taxpayers are watching! Comments are closed.

|

If you wish to further discuss blog posts, please contat our office directly or contact us via Contact page.

Categories

All

|

RSS Feed

RSS Feed