|

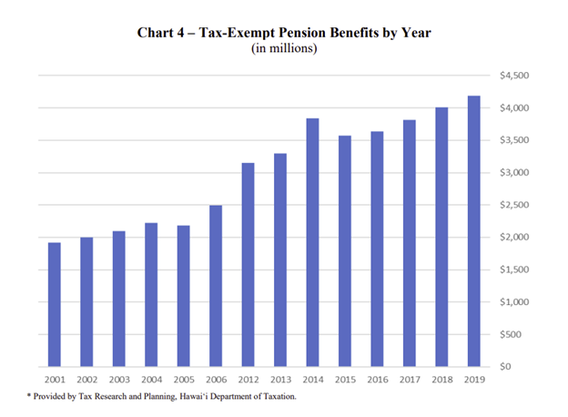

Spotlight on Retirement Income This week we continue our series on the recommendations made by the Hawaii Tax Review Commission. “Hawai‘i taxation of retirement income is neither fair nor equitable,” they say. “The exemption of large portions of retirement income impairs tax adequacy.” Their recommendations: “Tax pension and other retirement income uniformly. Exempt a base amount of pension income initially. Continue to exempt Social Security benefits from income tax.” Hawaii taxation of pension income is somewhat of a mixed bag. Our income tax law has an exemption for “compensation received in the form of a pension for past services” that has been on our books since Act 169 of 1953. When individual retirement accounts and self-employed retirement plans gained popularity in the 1970s, our Department of Taxation issued Tax Information Release 53-77 (1977), saying that it was limiting the pension exclusion to “plans fully funded by the employer,” on the theory that if the employee contributed to the retirement plan, the employee was in effect buying an annuity for himself or herself, and taxation would then follow the rules for annuities. Thus our tax laws allow employer-funded pensions to escape tax, while fully taxing 401(k) plans, IRAs, and other retirement vehicles that are funded through the employees’ choices. The Tax Review Commission slammed this distinction, saying that there is no economic justification for this. It was also clearly troubled by the sheer amount of pension benefits escaping the state income tax every year, which topped $4 billion in 2019: (Tax Review Commission Report, p. 20.) The Commission pointed out that Tax Review Commissions from prior years also struggled with this issue and recommended change.

Implementing the recommendation, however, has been a heavy lift politically. In 2014, then-Governor Neil Abercrombie became the first elected Democratic governor in Hawaii to be defeated in his bid for re-election. Honolulu Magazine cited his proposal to tax pensions as one of the nine reasons for his defeat. The Honolulu Star-Advertiser reported broad-based public opposition to the idea, even though it had been recommended by the Tax Review Commissions in 2003 and 2007. As the director of AARP Hawaii said at the time: “I think there is really deep concern, right across the board. … And it’s not that they’re just saying, ‘I don’t think this is a good idea.’ They are saying, ‘I think this is a terrible idea.’” Many seniors at the time expressed the view that they spent many years planning for their retirement and saw their pensions as a contract that the state wanted to disturb at a time when they were on fixed incomes and facing increased costs for health care or long-term care. The proposal to tax pensions did not pass, but voters still sent Gov. Abercrombie to the exit. Current politicians, fearing a similar fate at the ballot box, are expected to be wary when confronting this issue. In that respect it might not matter that our current treatment of pensions might be illogical, inconsistent, or uneconomic. Many voters have seen it as a sacred cow, and it is going to be very difficult to change.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

If you wish to further discuss blog posts, please contat our office directly or contact us via Contact page.

Categories

All

|

RSS Feed

RSS Feed