|

Showdown of the Juggernauts

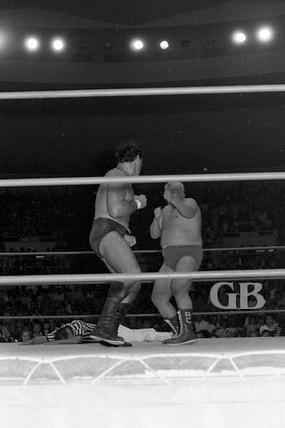

There is a huge fight looming on the horizon. I’m not just talking about Curtis “The Bull” Iaukea and Lord “Tally Ho” Blears versus Handsome Johnny Barend and the unforgettable Ripper Collins in “50th State Big Time Wresting” at the Civic Auditorium. I’m talking about something much, much more epic. In one corner you have the State of Massachusetts and in the other corner its neighbor the State of New Hampshire. Their arena: the Supreme Court of the United States. How did this fight come about? The traditional rule, which is followed by 41 states and the District of Columbia (the remaining 9 states, such as Alaska, Florida, and Nevada, don’t have income tax), is that income that has its source in a state other than where you live (the “non-residence state”) has the right to tax only that income. Your residence state has the right to tax you on that and any other income wherever you earn it, but it must give you a credit for tax legitimately paid to a non-residence state on income earned in that state. Before COVID-19, folks who lived in New Hampshire were commuting to work in Massachusetts. Massachusetts applied its income tax to them as non-residents. New Hampshire is one of the 9 states without an income tax. So, the only state income tax these folks paid was to Massachusetts. Then, along came COVID-19. A number of these employees, perhaps as many as 100,000, started to work from home. They found, to their delight, that Massachusetts tax didn’t seem to apply anymore because they weren’t commuting to Massachusetts. Massachusetts, however, didn’t really like the idea of its tax revenue being squeezed just because people stopped commuting. So, it adopted an emergency tax rule saying that the salary of any nonresident who worked for a Massachusetts company and was teleworking because of the pandemic would still be subject to Massachusetts nonresident income tax. “You can’t do that, it’s unconstitutional!”, New Hampshire roared, and marched to the Supreme Court to begin the epic fight. “Yes, we can!” bellowed Massachusetts. (If you’re interested in the details of their arguments, you can read them here.) Most recently, the Biden administration filed its brief, arguing that it’s inappropriate for the Court to stick its nose in now. It said that individual taxpayers who were hurt could file their own appeals and thus give the States’ courts a chance to weigh in before the Supreme Court would need to act. The outcome of that dispute may affect us here at home. Recently, some local folks established a “Movers and Shakas” program where they gave selected Mainlanders a free trip here in return for a commitment to stay on Oahu for 30 days and try being part of the Hawaii Ohana. The program drew 90,000 applicants for 50 spots in the first cohort, and the program is preparing for a second cohort. One thing that Movers and Shakas might not have told the winners is that their income might be considered Hawaii source, and taxable in Hawaii, because they are physically in Hawaii when they are working. The University of Hawaii Economic Research Organization (UHERO) put together a brief on this issue, calling it “Taxing Income in the New World of Teleworking.” It observed that some have called the traditional residence state and non-residence state rules archaic and ill-equipped to deal with what our economy has become over the years. UHERO considers this COVID-19 wrinkle a great opportunity to rethink the rules that apply to individuals who live in one state but work for an employer in another. Telework is here to stay. So are taxes. Now is a very good time for states and businesses to start thinking and talking about how the two mix.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

If you wish to further discuss blog posts, please contat our office directly or contact us via Contact page.

Categories

All

|

RSS Feed

RSS Feed